An example of our work in Sales&Distribution

Selling or delivering? Which of the two prevails, and when?

An example of our work done in Sales&Distribution

Hot to define and set up the commercial approach – in terms of system, resources, selling and delivery ways,… – is a fundamental question for all companies, whether they handle physical goods or services. The following example – taken from our direct experience with a key client of ours – illustrates the depth and competitive advantage of our approach and capability on the topic, and the huge impact that our work delivers to our clients.

In this specific example, our client, prior to our intervention, was firmly convinced that they had to transform their “No Order” Sales approach into an “Order” one. Also, they were convinced that the way to do this was to add a physical Sales rep that would go out and negotiate orders from customers. These beliefs of our client had been drawn by the fact that many companies in their industry had opted out for an “Order” sale.

Following our proved methodology, we assessed in details all the specific determinants of costs and revenues in the Sales&Distribution part of our client’s business model. What we found was that our client’s belief was completely wrong, and that, with their move, instead of generating an improvement they would have destroyed permanently their entire profitability.

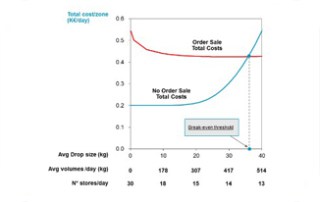

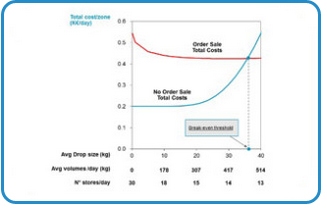

The first step of our work was to calculate the cost of delivery and of pure order taking (in the two cases of the key question for our client: “No Order” and “Order” sale). As shown in the following graphs, in not a single case (i.e. for whatever drop size, volumes sold or stores visited/day) the “Order” sale was better than the “No Order” one (the Total Sales cost was always higher).

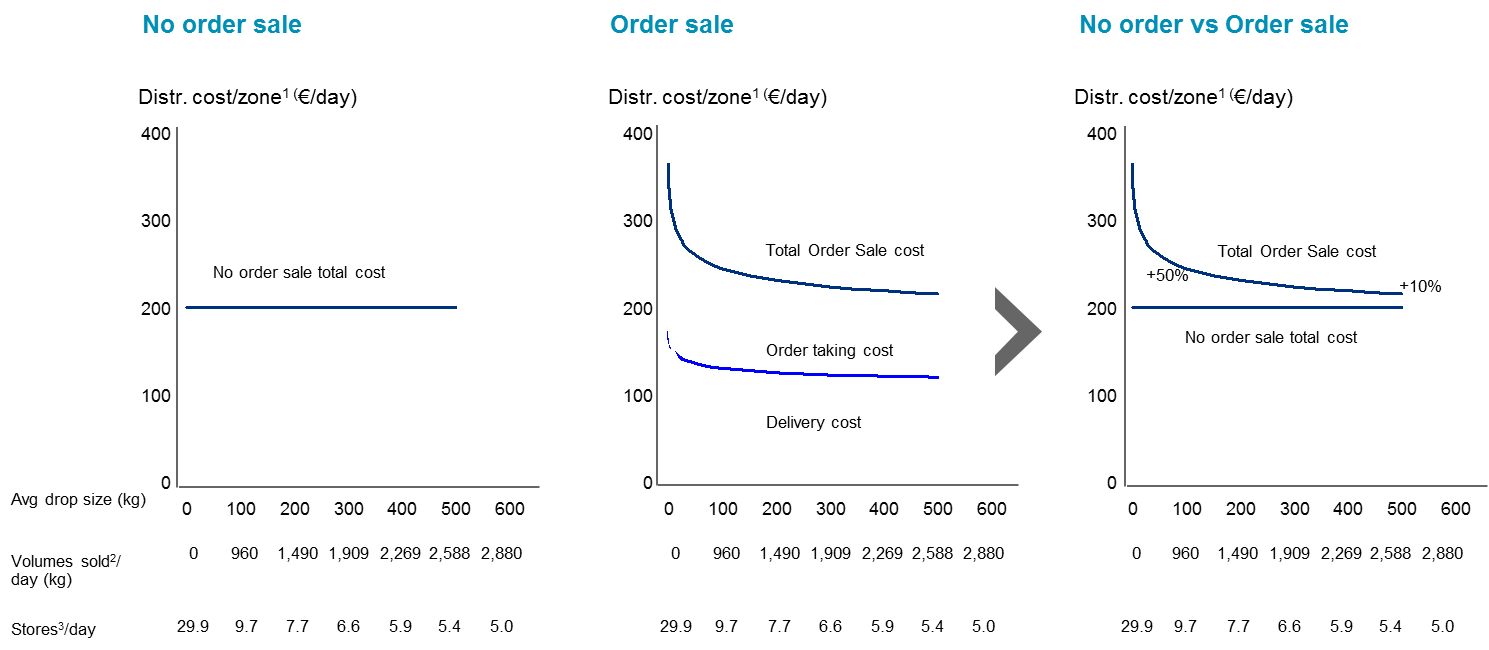

Then the key question was how comes many companies in the industry of our client had opted out for an “Order” type of sale. A reason in favor of the “Order” sale sits in the cost of stock and stock-out. This is a very complex cost to assess, depending on the statistical curves of products, clients, stores, seasonalities, daily and weekly variabilities, … Specificities that, moreover, depend on the detailed situation of each company (think for example at the specific margin value of each product, that in turn determines the cost of the stock out of that specific product).

The second step of our work was therefore to calculate the cost of stock and stock-out for our client, actually of each product of our client’s portfolio, and to combine all the results and complexities addressed. As shown in the following graphs, there is now a break-even point beyond which the “Order” sale becomes economically better than the “No Order” one.

It is interesting to note that, for our client’s specific situation, the cost of stock was always negligible (vs the other costs), while the cost of stock-out is material. The only thing is that the cost of stock-out becomes material only for high values (of drop sizes, volumes/day, stores visited,….), determining the existence of a break-even threshold.

But the problem doesn’t stop here. There is the need to calculate two other factors that affects the economic equations:

the “sales effectiveness” factor

the “territorial dis-optimization” factor.

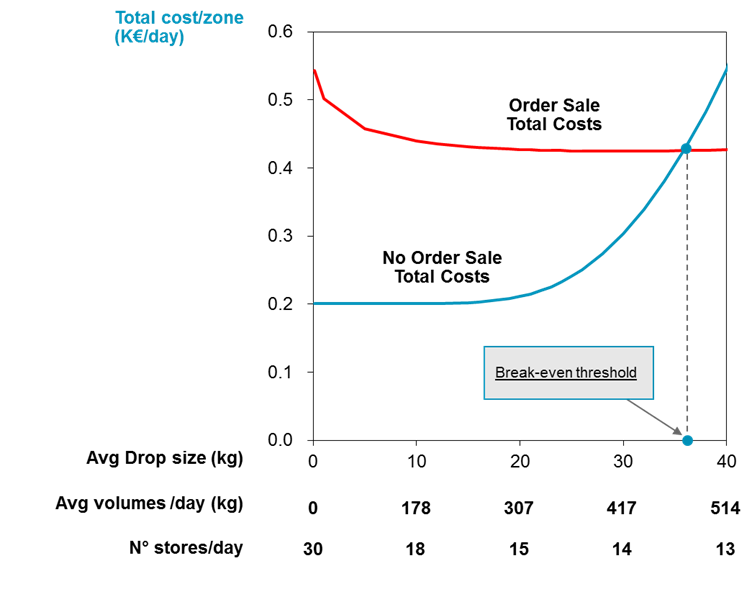

These effects are very complex to make. Just as an example, look at the final result of the territorial dis-optimization effect for our specific client (graphs below): in their case, this effect was “moving” the break-even threshold forward, making it even less advantageous for our client to opt for an “Order” type of sale.

By combining together all the pieces of analysis that we performed and leveraging our methodology (see for example the below graph), we were able to find that our client was far behind the break-even threshold.

This means that, by transforming their sales approach into an “Order” driven one, they would have damaged severely their P&L. To which extent? We calculated that their move – by almost doubling their Sales&Distribution costs at parity of sales – would have turned a highly profitable company into a deeply unprofitable one. In a few words: we saved their life.